As much as one other labels There isn’t particularly strong feedback

Evergreen and Emerging brands will most likely keep a slowly terminal refuse as names such as for instance Match and you can OkCupid consistently stage regarding relevance. I don’t have one standard for their emerging names such Brand new Group and Archer, the Grindr opponent. Likewise I don’t have one good feedback about Match Group Asia and you may pledge they can simply continue steadily to sit steady. There clearly was optionality indeed there as the Asia is an enormous, underpenetrated business yet not I won’t feel carrying my breath. Overall this type of names might be headwinds in the organizations progress, however given that Evergreen labels still decline and you may Rely continues to develop they are going to rating more and more reduced highly relevant to the fresh new performance of the firm.

If you’re there are a variety various prospective outcomes top and you may bad than just these types of, it’s obvious that the market is prices Match since the ex growth when in fact it’s got a quick increasing asset when you look at the Count and a good options on turning Tinder to

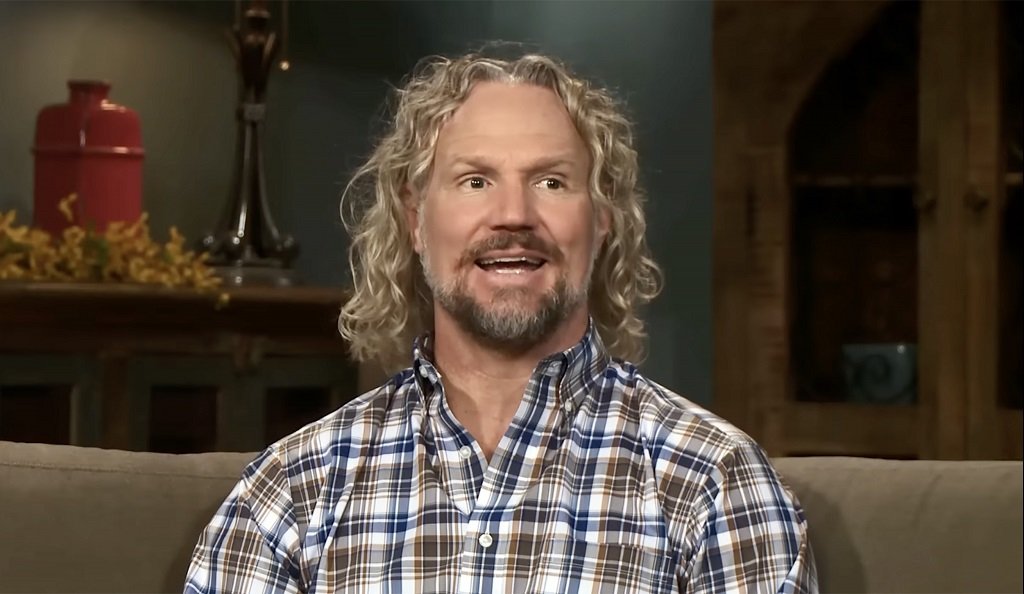

In advance of i www.kissbridesdate.com/fr/femmes-africaines/ talk about this new financials I recently need certainly to touch to my biggest concern, administration. Fits Group has had step 3 CEO’s due to the fact list when you look at the 2019 and you will a large amount of management turnover typically. Their you will need to transfer to brand new metaverse and much more standard public relations for the 2021 was an emergency, though the drivers of the disperse are not any extended on organization. Bernard Kim, the modern Chief executive officer was previously president off online game company Zynga hence possessed programs such as Farmville and you can Conditions which have Relatives. When you are his track record having Zynga is very good, issues were increased as much as their understanding of the firm and if his mobile games mindset deal out to dating applications efficiently. Concurrently, he has got started criticised having poor communication, together with latest quarterly money call making loads of temperature.. A few things I’d notice regarding the administration generally. To start with, he could be aimed that have shareholders as well as have recently been to purchase stock because the stock rates enjoys dropped over the past seasons. Next, I am delighted and their decision to buy right back stock aggressively over the past seasons at the the things i look for because attractive membership. When i do not have strong self-confident views regarding the management, I am happy to let them have the advantage of the fresh new doubt for now.

Considering all this I believe Fits category is at an glamorous valuation if in case they are able to continue steadily to develop gradually across the lasting. In accordance with the past one-fourth my harsh guess out of underlying work on price money try $760m, in the event that drop the following year if the payers continue steadily to decline. On an industry cap off $9.3b it throws Meets on an excellent P/Age out-of a dozen, which i faith is pretty practical for an organization you to wants in order to continuously develop within the perpetuity. Since business comes with $4b in debt, so it obligations is at sensible sandwich 5% repaired rates of interest. In lieu of repaying financial obligation the organization could have been aggressively buying straight back stock, with an excellent $1b buyback currently into the gamble immediately after currently to shop for straight back $1b out of stock before two years (admittedly against $430m from expensed inventory established settlement). Management has shown they are happy to aggressively repurchase stock and therefore on these types of valuations I do believe was an incredibly active entry to money.

In the long run, the present rhetoric are aimed with what I am wanting in the organization means smart specifically up to what they desire to be hired to your (Tinder advancements discussed over) as well as their approach shifting: investing in its core facts, coming back funding and not expanding in the interests of broadening

Whenever i don’t believe DCF’s try a particularly energetic type valuing a company, we are able to plug in some rough quantity discover a thought of what is cooked with the rates. Like, basically were to assume zero development in 2010, 5% progress for another ten years and dos% growth in perpetuity (that we faith is quite old-fashioned) we get in order to an eleven.5% irr. In my opinion this can be a scenario we could getting fairly safe with. At the same time, regarding the situation in which increases resumes and then we change so you can 10% and you may 4% 10 seasons and critical progress we have a superb fifteen% irr which i believe to get a very most likely situation. Even when the company were to stagnate, on a great several PE the firm has no huge downside.